The shares plunged in the year or so following its October 2021 initial public offering, then jumped late last year when the company reported stronger-than-expected quarterly results and showed progress on profitability targets. in New York trading, trimming the stock’s year-to-date gain to about 10%. Rent the Runway shares slipped 3.4% at 9:48 a.m. In the past couple of years, the company has boosted its gross margin and reduced the costs to ship out and take back its rental items. “We can make this investment into the customer with it having minimal impact on our gross margin,” Hyman said.

#RENT RUNWAY STOCK UPGRADE#

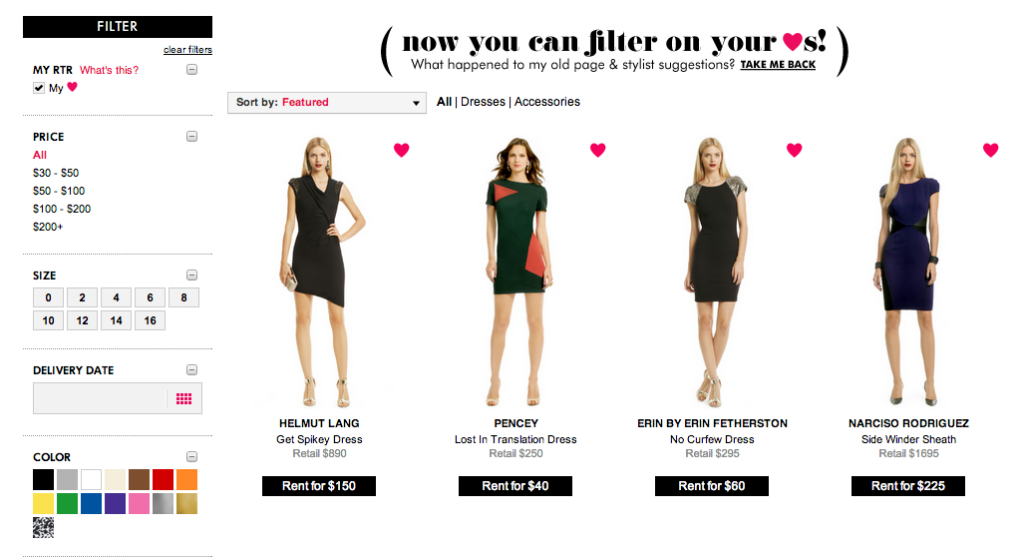

Read more: Rent the Runway Works to Swap Red for Black With Tech Upgrade Under the new plan, those subscribers will receive one more item in each shipment, or two per month. Rent the Runway’s most popular plan offers subscribers eight items a month via two shipments. “We get a lot more bang for our buck investing into the customer experience than investing into marketing.” “This business grows by women organically telling other women about Rent the Runway,” Hyman said. The more items that subscribers wear, the greater probability that someone will comment on their dress or sweater, accelerating word-of-mouth marketing. “The customer is more cost-conscious than she’s ever been before,” Rent the Runway Chief Executive Officer Jennifer Hyman said in an interview.Įxecutives considered cutting monthly subscription fees in response but decided instead to give consumers more for the same price, Hyman said, reasoning that it would help with both retention and appealing to potential customers.

Past results do not guarantee future outcomes.The additional items are a way to woo new consumers to subscribe to the monthly service even as inflation bites. For more information about the firm and its attorneys, please visit. The firm represents individual and institutional investors in securities class action and derivative lawsuits. Johnson Fistel, LLP is a nationally recognized shareholder rights law firm with offices in California, New York and Georgia. For more information, contact Jim Baker at (619) 814-4471 or Johnson Fistel, LLP. Under the SEC program, whistleblowers who provide original information may, under certain circumstances, receive rewards totaling up to thirty percent of any successful recovery made by the SEC.

What if I have relevant nonpublic information? Individuals with nonpublic information regarding the company should consider whether to assist our investigation or take advantage of the SEC Whistleblower program. Securities and Exchange Commission in connection with its October 2021 IPO and subsequent investor communications contained untrue statements of material facts or omitted to state other facts necessary to make the statements made therein not misleading concerning the Company's business, and operations.

Specifically, Johnson Fistel's investigation seeks to determine whether the Company's filings with the U.S. Since the IPO the stock has plummeted and on March 18, 2022, Rent the Runway stock closed at $6.75. What is Johnson Fistel investigating? On or around October 27, 2021, Rent the Runway conducted its initial public offering ("IPO"), the company sold 17 million shares Tuesday for $21 each after marketing 15 million shares for $18 to $21. Or for more information, contact Jim Baker at or (619) 814-4471 What if I purchased Rent the Runway common stock? If you purchased Rent the Runway common stock and suffered significant losses on your investment, join our investigation now:Ĭlick or paste the following web address into your browser to submit your losses: The investigation focus on investors’ losses and whether they may be recovered under the federal securities laws. ("Rent the Runway" or the "Company") (NASDAQ: RENT), any of its executive officers, or others violated securities laws by misrepresenting or failing to timely disclose material, adverse information to investors. SAN DIEGO, Ma(GLOBE NEWSWIRE) - Shareholder rights law firm Johnson Fistel, LLP ( is investigating whether Rent the Runway, Inc.

0 kommentar(er)

0 kommentar(er)